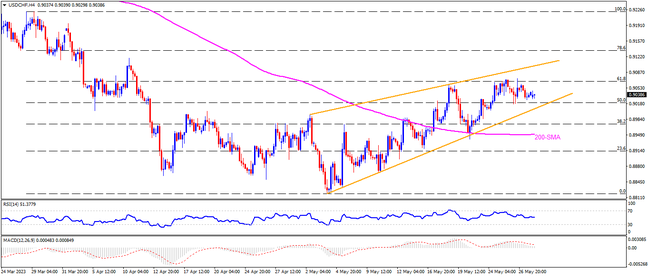

USDCHF fades upside momentum, after witnessing a three-week uptrend. With this, the Swiss currency pair portrays a rising wedge bearish chart formation on the four-hour chart. That said, RSI (14) line appears steady near the 50.0 level, suggesting no harm to the latest consolidation in prices. However, the bearish MACD signals suggest that the bears are gradually sneaking in. As a result, the pair bears may seek entry on breaking the stated rising wedge’s bottom line, close to the 0.9000 round figure. Following that, the 200-SMA of around 0.8950 and the yearly bottom of 0.8820 may act as extra filters towards the south before directing the pair to the theoretical target of the rising wedge around 0.8750.

On the flip side, USDCHF recovery needs validation from the 61.8% Fibonacci retracement of its late March to early May downturn, close to 0.9070. However, the April 10 peak of 0.9120 may limit the short-term upside of the quote afterward. Should the bulls cross the 0.9120 hurdle, the bearish chart formation gets off the table and can allow the buyers to challenge March’s high of near 0.9440, which is also the yearly high.

Overall, USDCHF is likely to witness further downside but the bears need to conquer the 0.9000 mark to tighten the grips.

Join us on FB and Telegram to stay updated on the latest market events.