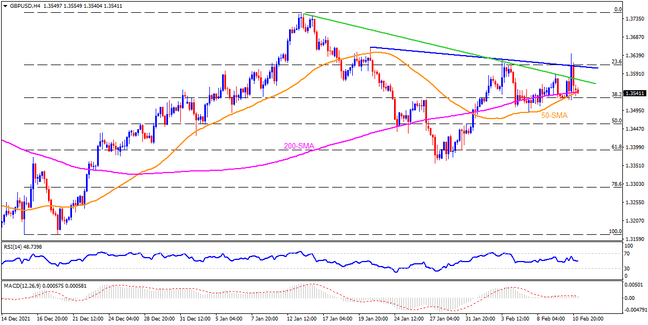

GBPUSD stays ready to reverse the month-start bearish signal, initially triggered by the 50-SMA’s break below 200-SMA, as markets await the preliminary reading of the UK Q4 GDP. However, the monthly resistance line and a descending trend line from January 20, respectively around 1.3585 and 1.3610, guard the quote’s short-term upside. During the pair’s run-up beyond 1.3610, the late January’s peak surrounding 1.3660 may offer an intermediate halt before directing the bulls towards the yearly top near 1.3750.

Meanwhile, a clear downside past 50-SMA level of 1.3530 rejects the odds of witnessing a bull cross, which in turn suggests a south-run towards the previous month’s low near 1.3355. That said, 50% and 78.6% Fibonacci retracements (Fibo.) of December-January upside, near 1.3460 and 1.3300 in that order, act as an extra filter during the declines.

Overall, GBPUSD bulls have a brighter scope to renew the 2022 peak given the positive support from UK GDP growth data.

Join us on FB and Twitter to stay updated on the latest market events.