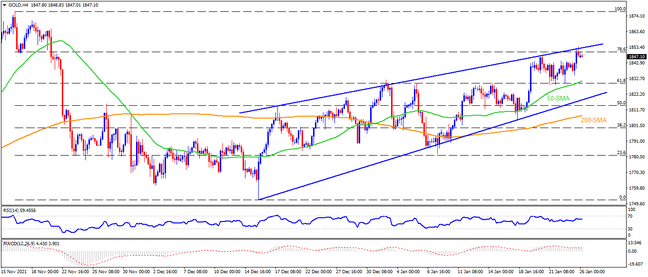

While a year-long resistance line has been testing gold buyers for one week, a six-week-old rising wedge bearish chart pattern teases sellers as markets brace for the Fed’s verdict. Given the sluggish RSI and receding bullish bias of the MACD, bears await a downside break of the $1,828 mark, comprising 50-SMA and 61.8% Fibonacci retracement of November-December downside. Following that, the lower line of the stated wedge near $1,816 becomes crucial as it holds the key to a slump towards September’s low near $1,721. During the fall, the 200-SMA level of $1,806 and $1,760 may offer intermediate halts.

Alternatively, an upside break of $1,848 will lure buyers but an upper line of the wedge, around $1,851, may test the run-up towards the $1,900 threshold. Also acting as upside filters are the tops marked in November and March months of 2021, respectively around $1,877 and $1,916.

On a fundamental side, the Fed is widely anticipated to hint for March rate hikes and balance-sheet normalization amid inflation fears. That said, a slight disappointment is enough for gold to rally towards $1,900 but the bears are so far trying to battle bulls amid hawkish hopes. Hence, it’s better to wait for the actual outcome.

Join us on FB and Twitter to stay updated on the latest market events.