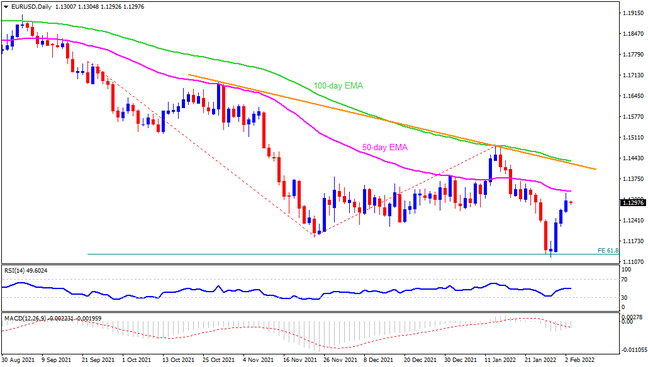

EURUSD extends bounce off a 19-month low, also comprising 61.8% Fibonacci Expansion (FE) of late September 2021 to early January 2022 moves, as traders await European Central Bank (ECB) monetary policy decision. With the recently high inflation and record low Unemployment Rate in Eurozone, the policy hawks are likely to dominate, which in turn could propel the major currency pair towards breaking immediate resistance, namely the 50-day EMA level surrounding 1.1340. However, a convergence of the 100-day EMA and a 14-week-old resistance line, around 1.1430-35, will be the key hurdle to cross for the confirmation of a short-term bullish trend.

On the contrary, a surprise dovish ECB statement wouldn’t hesitate to pour cold water on the face of EURUSD bulls by dragging the quote back to November 2021 low near 1.1185. During the fall, the 1.1300 and the 1.1230 levels may act as buffers before dragging prices towards the 61.8% FE retest, around 1.1125. If the pair bears keep reins past 1.1125, the early May 2020 peak surrounding 1.1020 will pause the south-run targeting the 1.1000 psychological magnet.

It should be noted that the ECB is widely anticipated to keep the benchmark policy rate unchanged at 0.0% and the monthly Asset Purchase Programme (APP) to €20 billion. In the last meeting, the ECB announced readiness to end the Pandemic Purchase Emergency Programme (PEPP) in March. For a smooth transition, the bloc’s central bank also unveiled an increase in the Q2 and Q3 APP to €40 billion and €30 billion respectively.

Join us on FB and Twitter to stay updated on the latest market events.