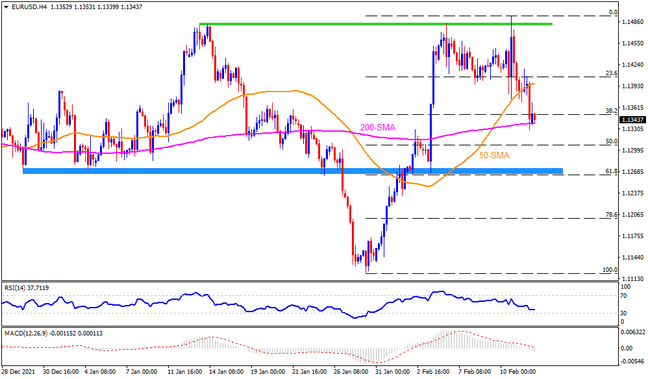

Be it increasing chatters over a 0.50% rate hike by the Fed in March or the US, EU and the UK’s signals for Russia’s imminent invasion of Ukraine, the US dollar has everything needed to consolidate early February’s losses. The same dragged EURUSD during the last week, which portrayed multiple tops around 1.1480 before ending the week by resting on 200-SMA. Given the downbeat fundamentals and the quote’s inability to cross the 1.1480 hurdle, not to forget downbeat RSI and MACD conditions, the major currency pair is likely to mark further losses.

That said, a clear downside break of the 200-SMA level near 1.1340 becomes necessary for the bears to aim for a six-week-old horizontal support zone around 1.1270-65. However, the quote’s further downside will make it vulnerable to conquer the 1.1200 threshold and aim for 1.1180 figures. Following that, January’s bottom of 1.1120 will be in focus.

Alternatively, corrective pullback needs to cross the 50-SMA level near 1.1400 to portray another battle with the resistance area around 1.1480. Also challenging the EURUSD bulls is the 200-week SMA level surrounding the 1.1500 round figure. If at all the pair buyers remain dominant past 1.1500, the recovery moves need validation from October 2021 low near 1.1530 before heading towards the 200-DMA on the daily chart, surrounding 1.1660, also comprising the 100-week SMA on the weekly format.

Join us on FB and Twitter to stay updated on the latest market events.