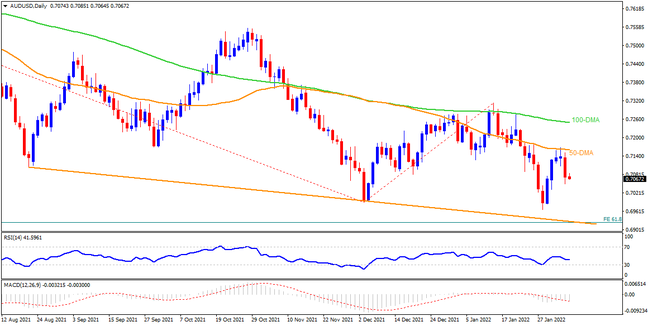

AUDUSD marked a notable U-turn from the 50-DMA by the end of the key week. As RSI and MACD conditions back the recent weakness, another south-run towards breaking the 0.7000 psychological magnet can’t be ruled out. However, a convergence of the downward sloping trend line from August and 61.8% FE level of June 2021 and January 2022 moves, near 0.6920, become strong support. If at all the bears keep reins past 0.6920, the 0.6900 threshold may test the further downside towards June 2020 swing lows surrounding 0.6780.

Alternatively, 50-DMA level surrounding 0.7165 guards immediate recovery moves of the AUDUSD prices. Following that, the 0.7200 round figure and the 100-DMA level of 0.7250 will be important to watch. It’s worth noting, however, that the pair’s rebound remains elusive below the previous month’s top of 0.7315.

On a fundamental side, China’s return from the Lunar New Year holidays will highlight AUDUSD as a lot has happened in the last week and Beijing will need to react to the hawkish monetary policy signals by the major central bank.

Join us on FB and Twitter to stay updated on the latest market events.