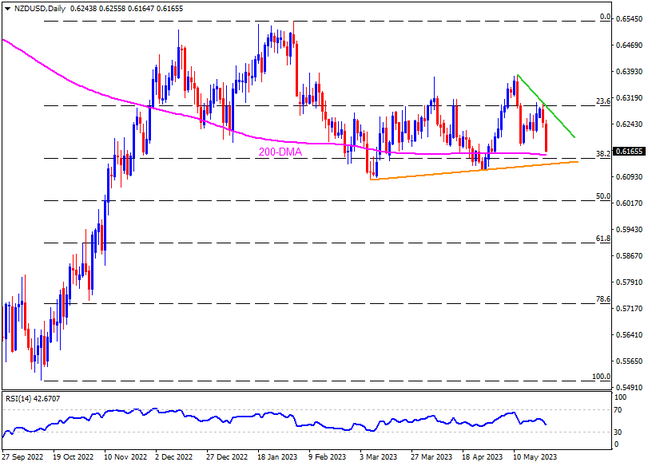

NZDUSD fails to justify the RBNZ’s 0.25% rate hike as it drops the most in a week after the Interest Rate Decision. The reason could be linked to the New Zealand central bank’s keeping of top rate level and the Governor’s inability to defend the hawkish move. With this, the Kiwi pair drops towards the 200-DMA support of around 0.6150. However, an upward-sloping support line from early March, close to 0.6130 by the press time, may challenge the pair sellers afterward. In a case where the NZDUSD remains bearish past 0.6130,s the yearly low marked in March around 0.6105 and the 0.6100 may act as the last force to stop the sellers.

On the contrary, a two-week-old descending resistance line near 0.6305 restricts the immediate upside of the NZDUSD pair during any recovery. Following that, the monthly high of around 0.6385 and the 0.6400 round figure may prod the Kiwi pair buyers before directing them to the yearly high of around 0.6540, printed in February.

Overall, NZDUSD is likely to decline further but the room towards the south appears limited.

Join us on FB and Telegram to stay updated on the latest market events.