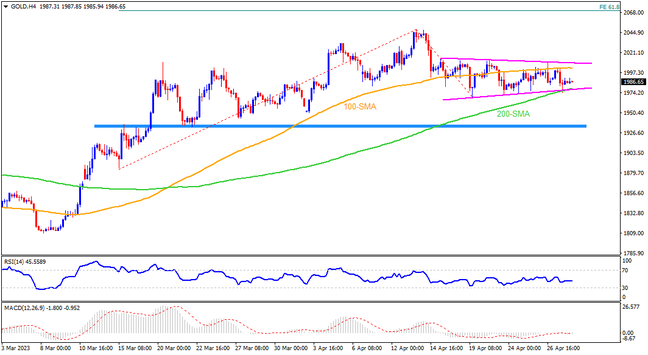

Repeated attempts to mark a downside break of the $1,980-79 support confluence comprising a fortnight-old symmetrical triangle, as well as the 200-SMA, keep Gold bears hopeful of posting a third weekly loss in a row. However, a six-week-long horizontal support zone around $1,935 appears a tough nut to crack for the XAUUSD sellers, especially amid the downbeat RSI (14) line. Should the metal prices remain weak past $1,935, the $1,900 round figure and the mid-March swing low of around $1,885 will be in the spotlight.

Meanwhile, a corrective bounce in the bullion price needs to stay beyond the 100-SMA and top line of the stated triangle, respectively near $2,003 and $2,010, may gold the Gold buyers. It’s worth noting that the quote’s successful trading past $2,010 enables it to challenge the YTD peak of near $2,050 whereas any further advances could aim for the $2,070 key hurdle comprising the previous yearly top and the 61.8% Fibonacci Expansion (FE) of the metal’s March 15 to April 19 moves.

Overall, Gold stays on the bear’s table after an initial attempt to lure the bulls. However, the next week’s Federal Reserve (Fed) monetary policy meeting outcome will be crucial to watch for clear directions.

Join us on FB and Telegram to stay updated on the latest market events.