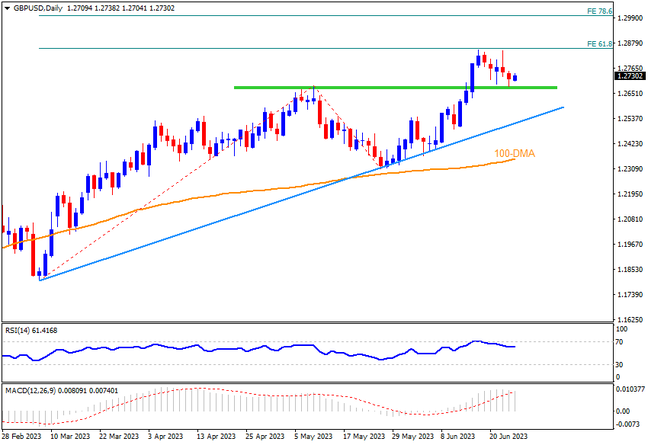

Despite posting the first weekly loss in four, the GBPUSD pair stays beyond the key supports. Not only that but the RSI (14) also retreats from overbought conditions and hence the fears of a pullback are off the table. That said, the MACD signals are bullish, which in turn backs the buyers to renew the upside momentum. That said, the latest peak, also the 61.8% Fibonacci Expansion (FE) of March-May moves, near 1.2850, appears the immediate target for Cable buyers. Following that, the lows marked during March 2022 join the 78.6% FE to highlight the 1.3000 as a strong resistance to watch. In a case where the pair remains firmer past 1.3000, the late 2021 bottom of around 1.3160 will be in the spotlight.

Meanwhile, the previous monthly high of near 1.2680 acts as immediate support for the intraday sellers of the GBPUSD pair to watch. Following that, an ascending support line from early March, close to 1.2510, immediately followed by the 1.2500 round figure, will be important hurdles for the bears to conquer to retain control. It’s worth observing that the 100-DMA level of around 1.2350 and the previous monthly low surrounding 1.2300 act as the last battle points for the Cable buyers before relinquishing control.

Join us on FB and Telegram to stay updated on the latest market events.