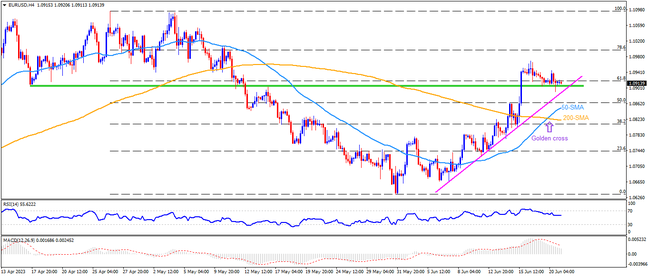

EURUSD pares the biggest weekly gain since early January ever since it reversed from the monthly high on Friday. In doing so, the Euro pair prints the first weekly loss in three as Fed Chair Powell’s testimony looms. However, a golden cross on the moving average, that is a condition where 50-SMA pierces the 200-SMA from below, joins the quote’s sustained trading beyond a fortnight-old rising support line to keep the buyers hopeful. Hence, the immediate trend line support, close to 1.0875 at the latest, precedes the 50-SMA of near 1.0840 and the 200-SMA surrounding 1.0820 to act as the final defense of the Euro buyers. Also acting as the downside filter is the early-month peak of around 1.0775, a break of which can quickly drag the pair to the previous monthly low of 1.0635.

Meanwhile, the EURUSD recovery needs to remain successfully high past the two-month-old horizontal support zone surrounding 1.0900-910. In that case, the weekly high of 1.0970 and the 1.1000 psychological magnet can challenge the bulls. Following that, the double tops marked in late April and early May, just below the 1.1100 round figure, will be crucial for the buyers to cross to confirm their ruling.

Overall, the EURUSD appears slipping off the bull’s radar but the bears need validation from technicals, as well as from Fed’s Powell, to retake control.

Join us on FB and Telegram to stay updated on the latest market events.