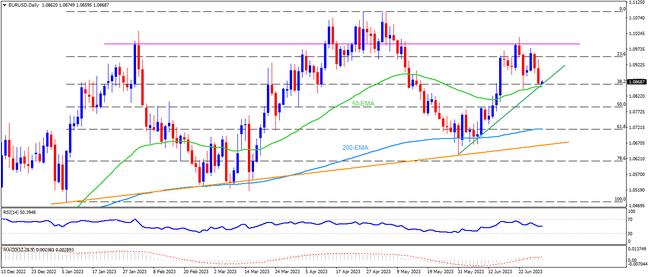

EURUSD holds onto the previous week’s U-turn from a five-month-old horizontal resistance while bracing for the second weekly loss, targeting the 50-EMA support of around 1.0850 of late amid a looming bear cross on the MACD. That said, the RSI (14) line’s retreat from the overbought RSI also suggests the Euro pair’s further weakness and hence the pair’s fall past the 50-EMA to the 50% Fibonacci retracement of January-April upside, near 1.0785, can’t be ruled out. However, a convergence of the 200-EMA and the 61.8% Fibonacci retracement, close to 1.0715-10, appears a tough nut to crack for the sellers. Even if the quote manages to break the 1.0710 support confluence, an upward-sloping support line from January, surrounding 1.0670, will act as the final defense of the buyers before giving control to the bears.

It should be noted, however, that the EURUSD pair’s recovery from the 50-EMA support will be difficult unless crossing the multi-month-old horizontal resistance area around 1.0990. Also acting as the short-term upside hurdle is the 1.1000 psychological magnet. Following that, the yearly high marked in April near 1.1095 holds the key to the major currency pair’s rally toward the March 2022 peak of 1.1185.

Overall, the EURUSD is likely to witness further downside but the road towards the south won’t be smooth.

Join us on FB and Telegram to stay updated on the latest market events.