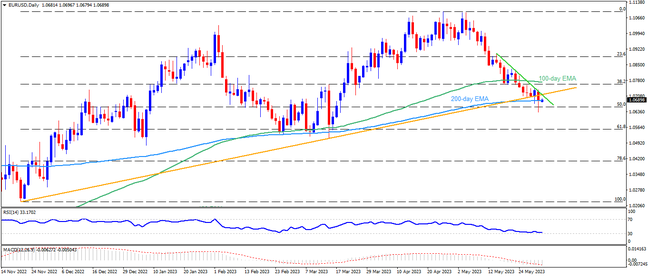

EURUSD’s break of a six-month-old ascending support line, as well as poking of the 200-day EMA, set the tone for the major currency pair’s additional weakness as markets await the Eurozone inflation and US employment numbers. Adding strength to the downside bias are the bearish MACD signals. However, the RSI (14) is nearly oversold and hence suggests bottom-picking, which in turn highlights the 1.0600 round figure as short-term key support. Following that, the 61.8% Fibonacci retracement of the pair’s late November-April upside, near 1.0555 will precede the lows marked in March and January, respectively near 1.0515 and 1.0480 as the last defense of the buyers.

On the contrary, EURUSD recovery may initially battle with the 1.0700 round figure to convince intraday buyers. Following that, a convergence of the aforementioned support-turned-resistance line and the two-week-old falling trend line, near 1.0715, will precede the 100-day EMA hurdle of 1.0775 to restrict the short-term upside of the major currency pair. In a case where the quote remains firmer past 1.0775, multiple levels around 1.0845-50 may prod the bulls before giving them control.

Overall, EURUSD lands on the bear’s radar as the key factors loom.

Join us on FB and Telegram to stay updated on the latest market events.